Hero

JSS component is missing React implementation. See the developer console for more information.

What global markets can learn from North America’s experience

The US, Canada, Mexico, and Argentina transitioned from a T+2 to a T+1 settlement cycle in May 2024, following earlier moves by India and China. With 20 percent of US securities owned by foreign investors, this shift significantly impacts global markets.

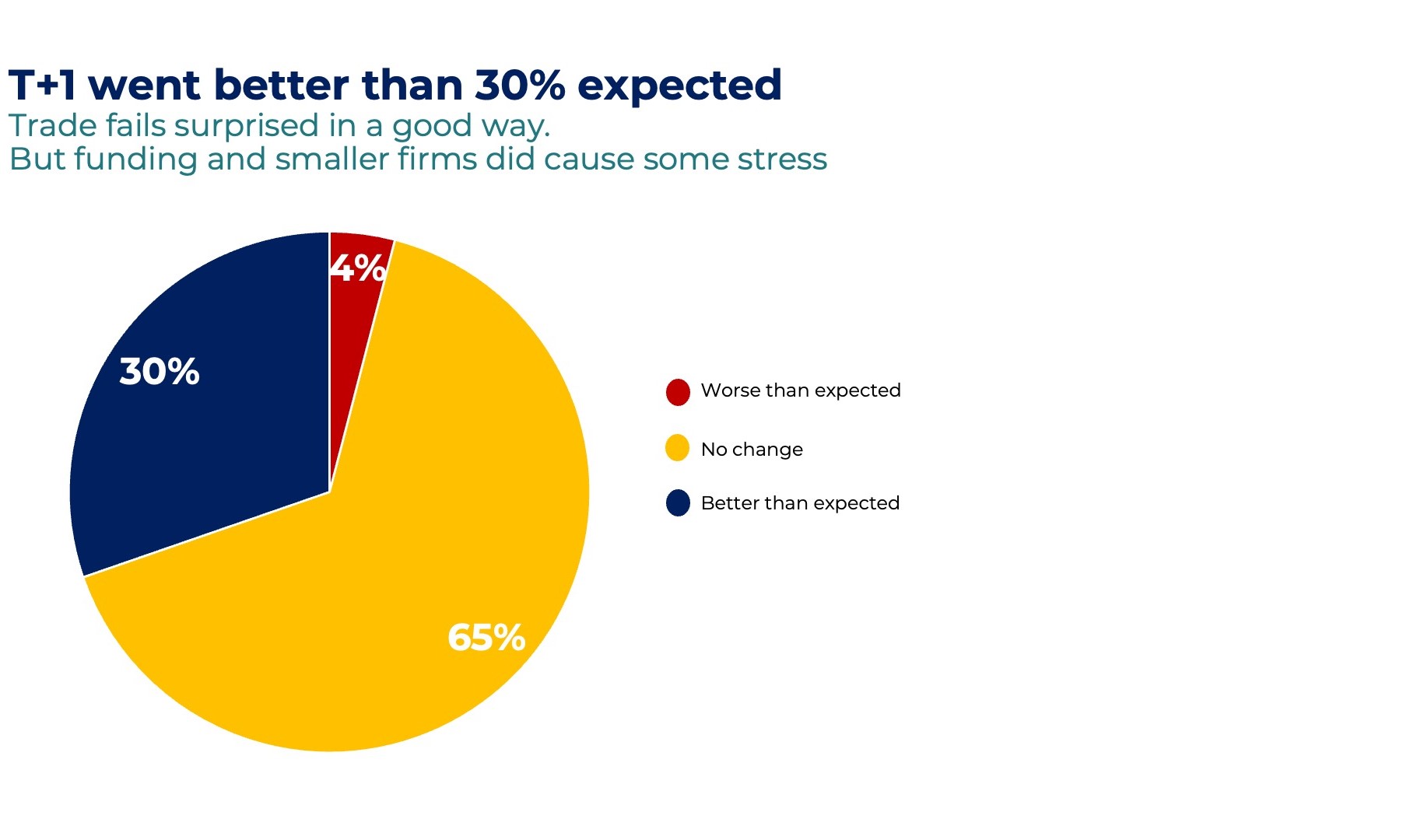

The T+1 migration in North America has been smooth and successful, as confirmed by the ValueExchange Pulse Survey and our clients at the SimCorp Americas Summit. This has prompted other regions to consider similar moves. The European Securities and Markets Authority (ESMA) recently published a proposal for the EU T+1 move by October 2027, following the UK’s Accelerated Settlement Taskforce intentions to move by end of 2027 latest. Meanwhile, the Asia-Pacific region is also exploring T+1, with Australia and New Zealand expected to outline their strategies soon.

As the world moves toward shorter settlement cycles, the need for automation, standardization, and system integration becomes increasingly important.

The ValueExchange: T+1 Pulse Survey

The North American experience with the T+1 settlement

The benefits

The challenges

Key learnings from the North American transition

As other markets prepare for their own shift to T+1, they can draw valuable insights from the US experience:

- Early definition of instrument scope: Defining the scope of instruments for T+1 early in the process is crucial to avoid confusion and delays. Early clarity allows all market participants to prepare effectively.

- Automation is key: Insufficient focus on automation in North America led to increased manual processing and exception management. Future transitions should prioritize automation from the outset to streamline operations and reduce friction. The UK taskforce, for instance, is emphasizing this in its recommendations.

- Market communication and leadership: The DTCC played a key role in guiding the US market and implementing essential tech changes. In Europe, where no single centralized player like DTCC exists, effective coordination across multiple institutions will be essential to ensure market readiness.

- Upstream processes are the challenge: The biggest challenge lies not in the settlement itself but in upstream processes, which must be compressed and automated to enable smooth settlements. Addressing these areas early will be key to success.

- International coordination: The US encountered challenges in aligning with regions operating under longer settlement cycles. Closely interconnected markets should adopt a coordinated approach to prevent similar issues.

- Addressing funding and liquidity: The Thursday funding issue seen in the US highlights the challenges of global markets. To avoid disincentivizing international investors, markets must carefully consider time zone differences and the impact of weekend settlements. Coordinating funding requirements and settlement windows across regions will be crucial for maintaining liquidity and ensuring a seamless transition.

Looking ahead: The future of global settlement cycles

The transition to T+1 settlement cycles is driving significant transformation within global financial markets. As regions like Europe and Asia-Pacific prepare for their own shifts, North America’s experience highlights the importance of automation, agility, liquidity management, and harmonized global standards to prevent fragmentation. Having the right technology in place is crucial, as it provides the foundation for flexibility and adaptability to these changes.

By embracing these advancements, markets can reduce settlement risks, enhance operational efficiency, and foster a more resilient global financial ecosystem. Although the journey towards T+1 is challenging, it promises a future of greater stability, integration, and opportunity for market participants worldwide.