Tax loss harvesting shouldn’t be a (tax) drag

For wealth managers

Author

Sercan Yildiz, Research Director, SimCorp

Still talking only about pre-tax performance with your clients?

If you are a wealth manager, you are unlikely to have had a conversation about the performance of your clients' portfolios without talking about taxes. Yet, surprisingly, much of the research and discussion about portfolio management is based on pre-tax returns. To deliver the best post-tax performance for your clients – whether that's a handful of accounts or thousands of accounts – you may want to take into consideration tax efficient investing and portfolio management. And if you do go down this route, there are scalable and efficient ways to do this on an active, systematic basis.

What is tax loss harvesting?

In the current US tax code, the capital losses realized by selling assets and securities at a loss can be used to offset the capital gains realized in the same tax year or applied to subsequent tax years. In addition, by realizing short-term losses and deferring the realization of gains, your clients can take advantage of the lower tax rates applied to long-term capital gains. Effectively, the harvesting of these losses can be seen as a credit that improves the portfolio's overall return. We term this, tax alpha.

Why not sell securities at a loss and then repurchase them immediately? In a world without transaction costs, selling a security that has a loss and claiming tax benefits would always be advantageous if the same security could be purchased again immediately. However, there are regulations preventing the recognition of losses from such wash sales in practice. In fact, you would not be able to claim the loss from that security for tax purposes if you purchase it within 30 days before or after the sale.

Impact of tax alpha

But what impact can these tax-managed investment strategies really have? Quite a lot actually, according to a whitepaper authored by our Research Director Sercan Yildiz. In his paper titled Generating Tax Alpha with Optimized Index Tracking: A Detailed Case Study for Wealth Managers, Sercan uses the Axioma Portfolio Optimizer (APO) to backtest optimized tax loss harvesting strategies and a tax-agnostic strategy tracking the Russell 1000 and Russell 2000, two broad cap-weighted equity market indices.

Spoiler alert: The results overwhelmingly support active, tax-aware portfolio management.

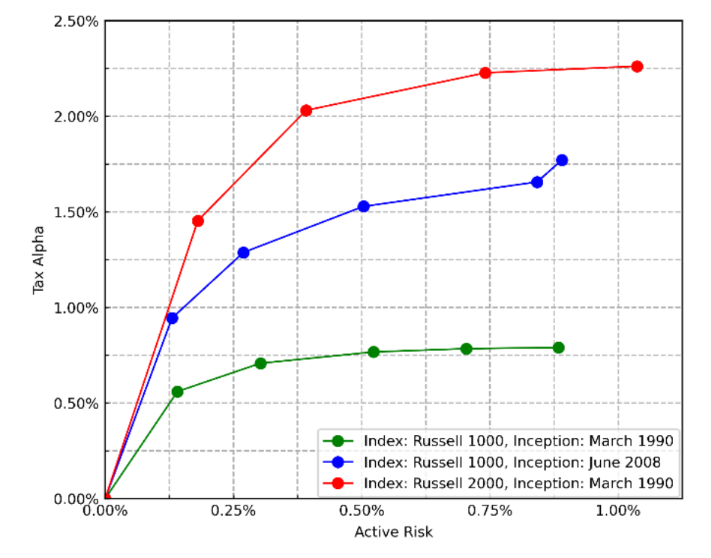

For example, in Figure 1 below, the results show that an optimization based approach for tax loss harvesting can provide significant tax alpha while at the same time, controlling tracking error to the index – even at moderate tracking error levels. Using a target tracking error of 25 bps with respect to the Russell 1000, a tax loss harvesting strategy can generate 71 bps of annualized tax alpha over a tax-agnostic investment strategy1.

Figure 1: Tax alphas and realized active risks of selected tax-managed portfolios

Source: Axioma Portfolio Optimizer, FTSE Russell

Source: Axioma Portfolio Optimizer, FTSE Russell

What other factors impact tax alpha?

The paper outlines the results of several tests to determine the pre-tax and post-tax returns of both a tax-managed and tax-agnostic strategy under various simulations. This includes the impact of cash contributions and withdrawals, portfolio funding time and different tax rates. In addition to answering the overall question of which strategy delivers the best post-tax performance, Sercan also delves deeper into some other questions often asked by our wealth management clients:

- Is there an optimal time to fund a portfolio when it comes to capturing tax alpha?

- How much tax alpha can you harvest in an unlimited external gains scenario?

- What is the impact of benchmark choice on tax alpha?

A balancing act: tracking model portfolio vs minimizing tracking error

Ultimately, we know that as a wealth manager, your goal is to track model portfolios with the minimum amount of tracking error while harvesting tax alpha. These individual goals can be at odds with each other, which highlights the importance of having a powerful decision making tool that can balance the many competing asks in building and rebalancing portfolios. This is where the advanced technology of Axioma Portfolio Optimizer (APO) comes in. Examining the numerous trade-offs that you need to consider, APO will efficiently find the optimal portfolio with respect to your investment objectives while satisfying your constraints.

Even further complexity is introduced when you consider the high levels of customization necessary for each client and potentially over multiple taxable, tax exempt and tax deferred accounts. Thankfully, APO is able minimize tax drag and maximize after-tax returns at scale and can even manage multiple tax-related separately managed accounts (SMAs) concurrently, while also adhering to the wash sale rule and other specific tax regulations.

If you'd like to learn more about Axioma Solutions for Wealth Managers request a demo below.

Request a demo

“To deliver the best post-tax performance for your clients… you may want to take into consideration tax efficient investing and portfolio management.”

1 The strategies look at portfolios over March 1990 to December 2023 and/or June 2008 to December 2023

You may also like