When macro factors speak, investors should listen

Author

Melissa R. Brown, CFA

Head of Investment Decision Research

How do you identify a portfolio’s exposures to macroeconomic factors?

Macroeconomic exposures do not always account for substantial risk, and may not impact all types of portfolios, but there times when they can be quite significant. As with all risks, an equity risk factor model user should be aware of this and may want to mitigate the exposure, or at least understand how the macro economy has impacted portfolio returns.

That is where the Axioma Worldwide Macroeconomic Projection Equity Factor Risk Model (Macro Model) comes in. This model offers a unique way to see portfolio's exposures to macroeconomic factors, such as interest rates and inflation, while maintaining the structure and benefits of a more traditional fundamental equity risk factor model. With macroeconomic factors projected onto fundamental factors, the risk forecasts do not change; only the distribution of the risk varies1. The benefit of this approach is that the user sees a consistent risk forecast, while at the same time gaining a better understanding of how economic changes may impact returns.

Macro factor exposures hurt the FTSE Developed Markets Index

Unlike traditional fundamental style factors, which are standardized and generally close to zero when aggregated for a broad collection of stocks, the macroeconomic factors in this equity risk factor model are calculated as a beta times the original exposure to the fundamental factor. Therefore, even a broad benchmark like the FTSE Developed Markets Index may have significant macro exposures.

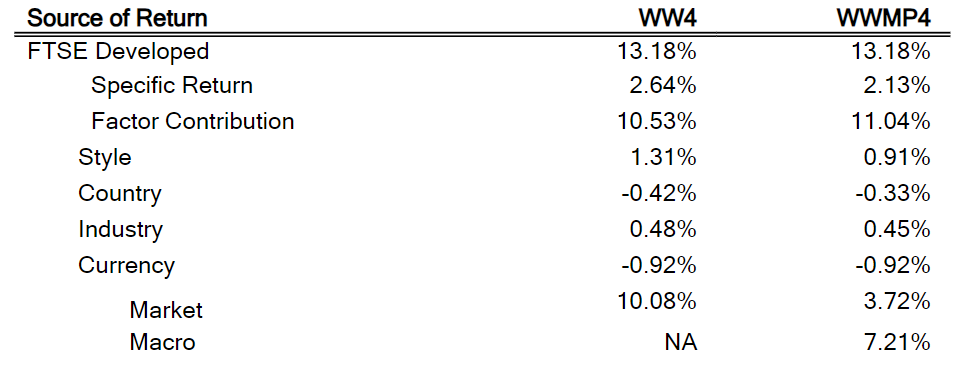

When looking at the attribution of the drivers of the FTSE Developed Markets Index annualized return for the five years ended December 2023, the standard Axioma Worldwide Equity Factor Risk Model - MediumHorizon (WW4) shows, as expected, that the major driver of return for the index was its exposure to the market. Using the Macro Model (WWMP4), however, shows that the market "would have" produced lower returns had the index's macroeconomic exposures not buoyed performance, contributing more than half of the total return of 13.18% (Figure 1).

Figure 1: Annualized return and factor contribution to FTSE Developed Index - Worldwide vs. Macro Model (2018 - 2023)

Source: Axioma Worldwide Equity Factor Risk Model, Axioma Worldwide Macroeconomic Projection Equity Factor Risk Model, FTSE Russell Indices

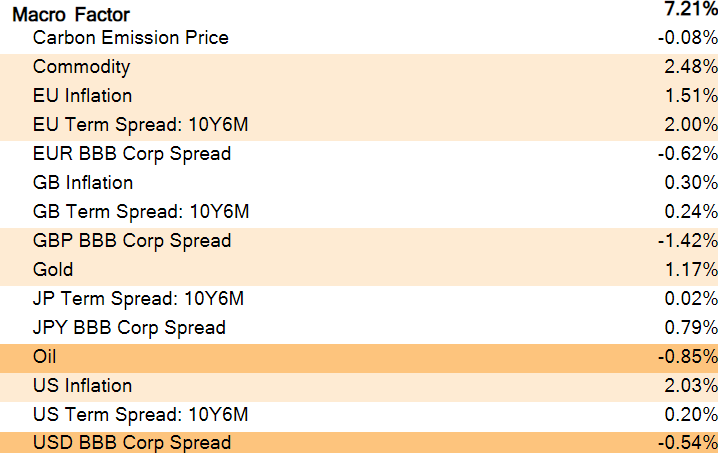

The biggest and smallest macro factor contributions

A detailed accounting of the return boost from the macro factors (Figure 2) shows that the positive exposure to non-Energy Commodities was the biggest contributor to returns, whereas credit spreads in the UK, hurt returns. Inflation in the US and EU propelled returns as well, as did Gold and EU Term Spreads. Whereas Oil and US Credit Spreads did not have a large impact over the full five-year period, they did contribute a good deal of return in certain periods. Most factors saw their biggest contributions in the period surrounding the COVID crisis in early 2020. Other macro factors had little or no impact on the index return.

Figure 2: Breakdown of macro factor contribution (annualized)

Source: Axioma Worldwide Macroeconomic Projection Equity Factor Risk Model, FTSE Russell Indices

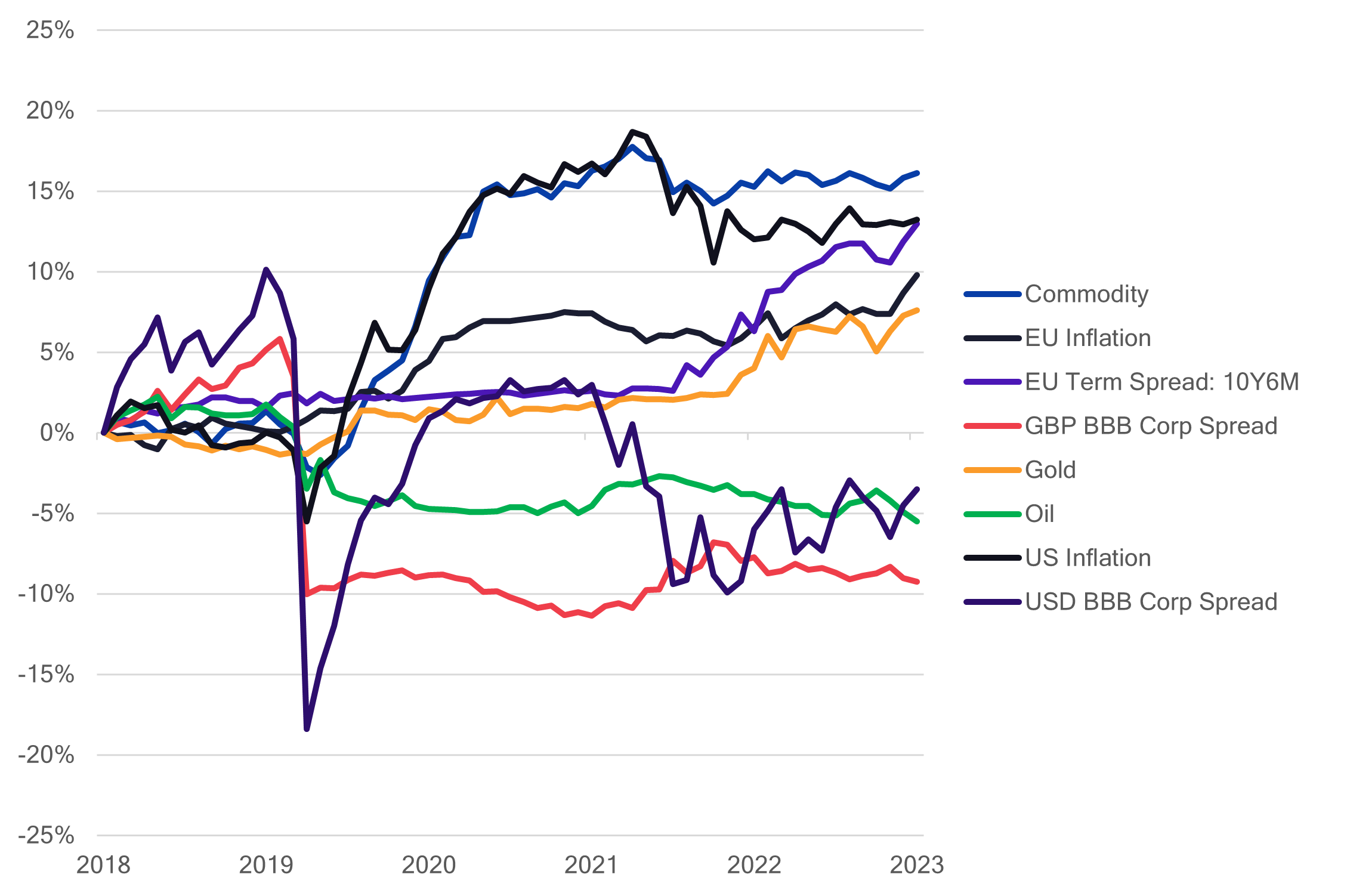

Drilling down for a deeper look at the time series, we note that Non-Energy Commodities exposure (“Commodity”), which was positive throughout the five-year period, but approached zero toward the end, had a large and consistent positive impact (almost 2.5% per year), although it leveled out over the last two years as the exposure fell. Inflation (EU and US) were also positive contributors in the first three years when the exposure was positive, but contribution leveled off with exposure a number of other factors were significant negative contributors (Figure 3).

Figure 3: Cumulative return contribution of highest contributing macro factors

Source: Axioma Worldwide Macroeconomic Projection Equity Factor Risk Model, FTSE Russell Indices

Of those, the generally negative GBP BBB Corporate Spread exposure (Figure 4) produced an adverse return contribution, mainly dragging down the return as the market fell in reaction to the Covid crisis in early 2020, despite a relatively small negative exposure at the time. (Remember that spreads widened substantially in March at the same time the market tanked). USD BBB spreads also clobbered returns but recovered and contributed quite positively over the next two years.

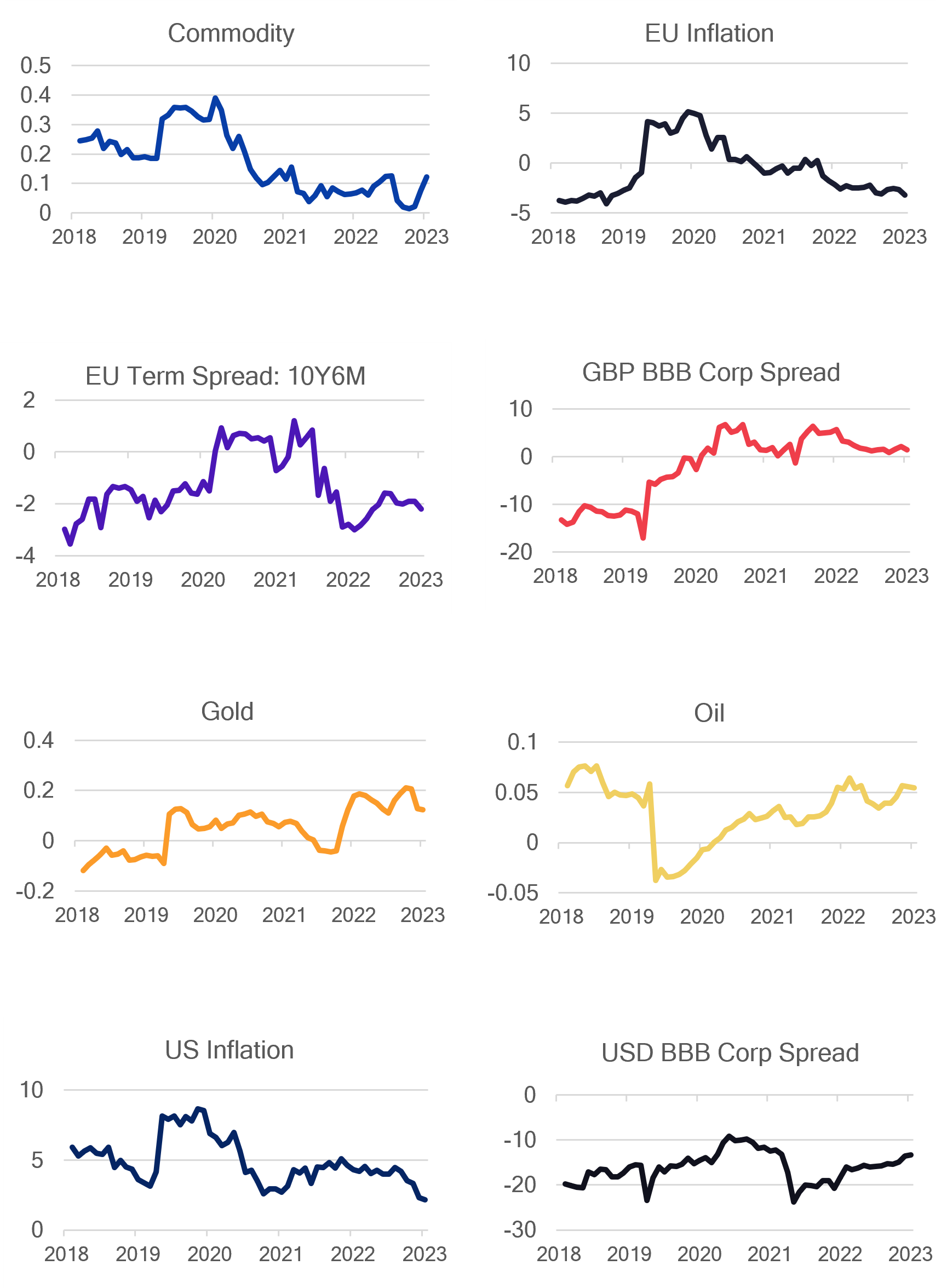

Figure 4: Exposures to highest contributing macroeconomic factors

Source: Axioma Worldwide Macroeconomic Projection Equity Factor Risk Model, FTSE Russell Indices

The sensitivity2 of the index to macroeconomic variables in the Macro Model has fluctuated substantially over time. In some cases, the sign of the sensitivity rarely changes, but the magnitude does (for example, US Inflation and Commodities). This means that we would expect the index to rise as the commodity price goes up or inflation increases. For other factors, the sensitivity fluctuates between negative and positive, and may therefore be even more important to track. In 2018 and 2019, the FTSE Developed World had a negative exposure to the GBP BBB Spread, so we would have expected the index to fall as the spread widened. By 2021 the exposure reached its five-year peak positive level as credit and equity markets settled down after the Covid crisis, suggesting that widening spreads would actually be good for equities. The exposure to EU Inflation went from negative to positive back to negative, as the level of inflation fluctuated substantially.

What’s driving what? Macro factors and returns

Although macro factors may be correlated with equity market returns, they do not necessarily drive the market – for some it is more likely that another variable is driving both simultaneously. An obvious example would be the concurrent decline in the market and the widening of credit spreads at the outset of the Covid crisis. Still, wider spreads can theoretically drive the market, since they may mean higher financing costs for high debt companies, or higher corporate yields may compete with expected stock returns and lead to funds flows from stock to bonds both hurting equity returns.

Other variables in the macro model may be more direct drivers of market returns. For example, rising oil and other commodity prices may benefit energy companies, but as an input may hurt manufacturing. Wider term spreads are typically a positive for banks, but as noted above may hurt the future financing ability of high-debt companies. A small amount of inflation is good for equities as companies are able to increase prices and may not see correspondingly higher costs, but higher inflation hurts both revenues and costs. These variables may therefore be more likely to drive correlation with causation.

Macro factor exposures may not always be significant but when they are, investors should take notice

Much of the time exposures are close to zero (for example, for the EU Term Spread). This suggests they are unlikely to have a major impact on the index. But when they do dip or soar, the effects may be significant. As the EU Term Spread sensitivity fell below zero in mid-2022 and the spread narrowed, it added more than 10 percentage points to the index return through the end of our test period. Or, as the USD BBB Spread declined from late 2021 to mid-2022, it detracted more than 10 percentage points. Imagine if you could have hedged that macro exposure!

Your results may differ, of course, especially in an active portfolio. This simple example was based on a broad index. The model is designed to recognize these exposures and their contributions to portfolio risk and return. It can also be used in portfolio construction to mitigate the types of risks we have noted here, or to allow users to bet more efficiently on the factors on which they have views, while maintaining the same overall total and active risk level as the standard fundamental model on which these factors have been projected. It may not be necessary for every risk review or portfolio rebalancing, but when the macro factors speak, investors should listen.

References

- Note that the style and industry exposures for the Macro Model are residual to the macroeconomic factors, so the interpretation of the exposures is different

- Note that we use "exposure" and "sensitivity" interchangeably here. One could also use the term beta.

“The sensitivity of the index to macroeconomic variables in the Macro Model has fluctuated substantially over time.”